Early in the Wisconsin Health Information Exchange (WHIE) we realized a high likelihood of finding information for a local provider or patient was key to a successful business case. (Techies call this “network dependency.”) So I wasn’t surprised November 28 to hear market share penetration labeled the single item that best distinguishes sustainable from struggling HIEs by the HIE Learning Network of the National eHealth Collaborative (NeHC). What is surprising is that HIE policy often disregards this vital factor.

At Technology Crossroads, Jeffrey Rose (ICG Group) and Delaware Health Information Network (DHIN) CFO Michael Sims presented factors identified by the Learning Network that distinguish profitable from unprofitable HIEs. (Other factors in addition to high market share penetration are aggressive pricing and investment in product development.) DHIN is verging on both 95% market penetration and long-term black-ink performance. (For more on this and other Learning Network lessons, join the December 17 NeHC University webcast.)* [Update: Dec 18: the Learning Network report has been published.]

Meanwhile, many HIEs around the country are struggling. The eHealth Initiative’s 2012 HIE survey lists sustainability as the top obstacle, and found that over half are encountering competition from other HIEs. They are also competing with HIT vendors providing exchange technologies directly to provider networks.

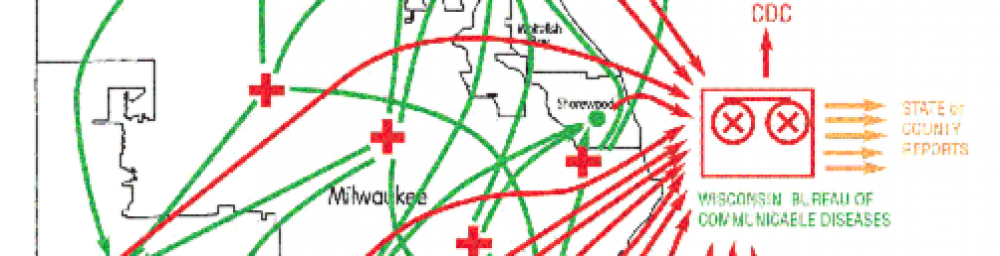

For example, the November 21 IHealthBeat reprinted a story from the Oct. 18 Tampa Tribune detailing how a public HIE serving hospitals is competing with a private HIE serving physicians. Meanwhile, in several states, new HIE entities created by the Office of the National Coordinator (ONC) State HIE grant program compete with pre-existing regional efforts. (Most early regional HIEs focused on medical marketplaces defined by referral patterns, not state lines.) Adding to the confusion are statements from ONC leaders that put exchanges developed inside Accountable Care Organizations (ACOs) on the same footing as regional “all-provider” HIEs. This fails to acknowledge that such private entities may aggressively compete, including taking information hostage. A recent New York Times story details how increasing provider consolidation (neither citing ACOs nor excluding them) can block clinical communication with competing providers.

Perhaps, at least initially, competition is toxic for successful health information exchange. In a 2007 eHealth Initiative report on HIE sustainability, we described social capital (resilient relationships among HIE stakeholders) as a key element for success.

An alternate scenario is that each electronic health record system will contain its own exchange capabilities (like the Direct “push” standard). But this model still works best with a “central switchboard” managing directories, authentication, record locators, and other services that an HIE can provide.

It seems that HIE resembles mail service, electrification, telephony, highways and fire services, possibly requiring a period as publicly-regulated, public service monopolies. Once the infrastructure is well established, competition can be introduced to accelerate innovation and price competition. Today, however, regional HIEs are competing with Federally-funded state HIE designated entities, which are competing with for-profits and ACOs. Meanwhile, market share is elusive, and network dependency can kill.

*Disclosure: I am currently on the NeHC University Advisory Board and a former NeHC board member.